Zomato is a well-known name when it comes to ordering food and has eventually become a household name in India’s food delivery space. But for investors, the big question is: What will be the Zomato share price target 2025, 2026, 2030, and so on… In this blog, we have considered past performance, current business strategy, and market conditions to predict Zomato share price targets. We have also provided brief steps on how to compute Zomato share price target tomorrow.

About Zomato

Zomato Limited is top food delivery and restaurant discovery platform in India. It connects users with local restaurants that allow them to browse menus, place food orders, read reviews, and make table reservations. Additionally, Zomato also supports restaurants with services like supply chain solutions (Hyperpure), digital marketing, and dining-out offers. In recent years, it has expanded into quick commerce also through Blinkit, which focuses on delivering instant grocery.

How Does Zomato Earn Revenue?

Zomato earns a major portion of its revenue by charging commissions on food orders placed through its app. Restaurants pay Zomato a percentage of the order value for each successful delivery.

It also generates income through in-app advertising, where restaurants pay to appear on the top of the searches.

Zomato has a subscription service called Zomato Gold. Users pay for it to get special deals and discounts, and this gives Zomato regular income.

It has a B2B platform, Hyperpure, where it sells ingredients and kitchen supplies to partner restaurants.

It also earns from Blinkit, its quick-commerce service, by delivering groceries and daily essentials in just a few minutes.

Zomato Share Price Target 2025

Current Price (September 2025) = Rs. 317. 70

Assumed Annual Growth: Around 7.5% (partial year, annualized) till Zomato share price target 2030 computation

Other Assumptions to compute Zomato share price target tomorrow:

- Zomato’s stock had grown ~22% over the past year (1Y CAGR), so we moderate expectations.

- Festive quarter (Oct–Dec) expected to drive high demand.

- Stable expansion, but not a breakout year due to macro conditions and profit drag.

Zomato Share Price Target 2025

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Aug 2025 | 317.00 | 319.91 | 309.00 – 328.00 |

| Sep 2025 | 319.91 | 322.84 | 312.00 – 333.00 |

| Oct 2025 | 322.84 | 325.78 | 315.00 – 336.00 |

| Nov 2025 | 325.78 | 328.73 | 318.00 – 339.00 |

| Dec 2025 | 328.73 | 331.69 | 321.00 – 342.00 |

Source: Dhan

Zomato Share Target Prices 2026 – 2030

Zomato Share Price Target 2026

Assumptions:

- Zomato has shown strong sales growth between 51%-69%) over 3–5 years and a 3Y stock CAGR of 70%.

- Zomato’s scale expands across Tier 2/3 cities with new revenue streams like Zomato Gold, Hyperpure, and logistics partnerships.

- Market sentiment stays bullish, expecting strong investor support in FY26.

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan 2026 | 331.69 | 336.33 | 321.00 – 346.00 |

| Feb 2026 | 336.33 | 341.04 | 326.00 – 351.00 |

| Mar 2026 | 341.04 | 345.82 | 331.00 – 356.00 |

| Apr 2026 | 345.82 | 350.68 | 336.00 – 361.00 |

| May 2026 | 350.68 | 355.61 | 341.00 – 366.00 |

| Jun 2026 | 355.61 | 360.61 | 346.00 – 371.00 |

| Jul 2026 | 360.61 | 365.68 | 351.00 – 376.00 |

| Aug 2026 | 365.68 | 370.82 | 356.00 – 381.00 |

| Sep 2026 | 370.82 | 376.04 | 361.00 – 386.00 |

| Oct 2026 | 376.04 | 381.32 | 366.00 – 391.00 |

| Nov 2026 | 381.32 | 386.67 | 371.00 – 396.00 |

| Dec 2026 | 386.67 | 392.09 | 376.00 – 401.00 |

Zomato Share Price Target 2027

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan 2027 | 392.09 | 396.98 | 380.00 – 409.00 |

| Feb 2027 | 396.98 | 401.94 | 385.00 – 414.00 |

| Mar 2027 | 401.94 | 406.97 | 390.00 – 419.00 |

| Apr 2027 | 406.97 | 412.07 | 395.00 – 424.00 |

| May 2027 | 412.07 | 417.24 | 400.00 – 429.00 |

| Jun 2027 | 417.24 | 422.48 | 405.00 – 434.00 |

| Jul 2027 | 422.48 | 427.80 | 410.00 – 439.00 |

| Aug 2027 | 427.80 | 433.18 | 415.00 – 444.00 |

| Sep 2027 | 433.18 | 438.64 | 420.00 – 449.00 |

| Oct 2027 | 438.64 | 444.17 | 425.00 – 454.00 |

| Nov 2027 | 444.17 | 449.77 | 430.00 – 459.00 |

| Dec 2027 | 449.77 | 455.44 | 435.00 – 464.00 |

Zomato Share Price Target 2028

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan 2028 | 455.44 | 460.78 | 442.00 – 474.00 |

| Feb 2028 | 460.78 | 466.17 | 447.00 – 479.00 |

| Mar 2028 | 466.17 | 471.61 | 452.00 – 484.00 |

| Apr 2028 | 471.61 | 477.11 | 457.00 – 489.00 |

| May 2028 | 477.11 | 482.66 | 462.00 – 494.00 |

| Jun 2028 | 482.66 | 488.27 | 467.00 – 499.00 |

| Jul 2028 | 488.27 | 493.93 | 472.00 – 504.00 |

| Aug 2028 | 493.93 | 499.65 | 477.00 – 509.00 |

| Sep 2028 | 499.65 | 505.41 | 482.00 – 514.00 |

| Oct 2028 | 505.41 | 511.23 | 487.00 – 519.00 |

| Nov 2028 | 511.23 | 517.10 | 492.00 – 524.00 |

| Dec 2028 | 517.10 | 523.03 | 497.00 – 529.00 |

Zomato Share Price Target 2029

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan 2029 | 523.03 | 528.69 | 508.00 – 539.00 |

| Feb 2029 | 528.69 | 534.41 | 514.00 – 545.00 |

| Mar 2029 | 534.41 | 540.19 | 519.00 – 550.00 |

| Apr 2029 | 540.19 | 546.03 | 524.00 – 555.00 |

| May 2029 | 546.03 | 551.93 | 529.00 – 560.00 |

| Jun 2029 | 551.93 | 557.89 | 534.00 – 565.00 |

| Jul 2029 | 557.89 | 563.91 | 539.00 – 570.00 |

| Aug 2029 | 563.91 | 569.99 | 544.00 – 575.00 |

| Sep 2029 | 569.99 | 576.13 | 549.00 – 580.00 |

| Oct 2029 | 576.13 | 582.33 | 554.00 – 585.00 |

| Nov 2029 | 582.33 | 588.59 | 559.00 – 590.00 |

| Dec 2029 | 588.59 | 594.91 | 564.00 – 595.00 |

Zomato Share Price Target 2030

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan 2030 | 594.91 | 600.63 | 579.00 – 618.00 |

| Feb 2030 | 600.63 | 606.41 | 584.00 – 623.00 |

| Mar 2030 | 606.41 | 612.24 | 589.00 – 628.00 |

| Apr 2030 | 612.24 | 618.13 | 594.00 – 633.00 |

| May 2030 | 618.13 | 624.07 | 599.00 – 638.00 |

| Jun 2030 | 624.07 | 630.07 | 604.00 – 643.00 |

| Jul 2030 | 630.07 | 636.12 | 609.00 – 648.00 |

| Aug 2030 | 636.12 | 642.22 | 614.00 – 653.00 |

| Sep 2030 | 642.22 | 648.37 | 619.00 – 658.00 |

| Oct 2030 | 648.37 | 654.58 | 624.00 – 663.00 |

| Nov 2030 | 654.58 | 660.83 | 629.00 – 668.00 |

| Dec 2030 | 660.83 | 667.14 | 634.00 – 673.00 |

Zomato Share Price Target 2025 by Experts

Long-Term Scenario Outlook for Zomato Share Price Target 2024 till 2026

Dalal Research offers a tiered projection related to Zomato share target price under three scenarios:

| Scenario | End of 2024 | End of 2025 | End of 2026 |

| Bear | ₹195 | ₹220 | ₹275 |

| Neutral | ₹270 | ₹312 | ₹345 |

| Bull | ₹307 | ₹385 | ₹505 |

Looking further ahead: By 2030, forecast ranges from ₹410 (bear) to ₹1,006 (bull)

Zomato Share Future: Key Highlights for Zomato Share Target Price

- Zomato has grown its sales by over 69% per year over the last 3 years,

- Even in recent quarters, revenue growth remains strong due to increase in online food orders, Zomato Gold subscriptions, and B2B (Hyperpure) expansion.

- Zomato was loss-making for years but recently showed signs of improvement with ROE rising to 2% last year.

Zomato Share Future: Challenges

- Zomato’s TTM profit dropped 50%, despite high revenue growth. It may take time before Zomato consistently delivers profits.

- Competitor challenges include from Swiggy, ONDC, and other platforms keeping aggressive pricing.

- Urban markets are mature. Growth will depend on Tier 2/3 cities and new services like quick commerce or dining-out experiences.

Future Growth Drivers for Zomato Ltd.

Tier 2 and Tier 3 locations hold significant growth opportunities for acquiring new users that can help in further expansions beyond major cities. The company’s initiative of supplying ingredients to restaurants opens a promising new revenue stream with high potential. Premium services and dining programs play a key role in retaining customers and boosting order frequency. About profitability margins, companies can leverage AI and logistics automation to decrease operational costs and enhance delivery efficiency.

Zomato Share Price Fundamental Analysis

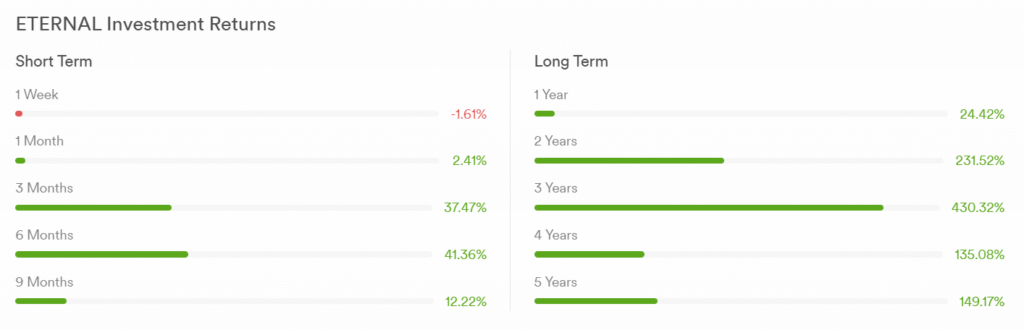

Zomato Past Return

Zomato Financial Performance Overview (FY2020 – FY2025)

| Fiscal Year | Revenue (₹ crore) | Revenue Growth (YoY) | Net Profit (₹ crore) | Profit Growth (YoY) |

| FY 2020–21 | 1,846 | -26.64 | -886 | 63.85% |

| FY 2021–22 | 4,109 | 110.69 | -1.098 | -23.935 |

| FY 2022–23 | 5,507 | +30.35% | 117 | 110.66% |

| FY 2023–24 | 7,542 | +40.68% | 1,371 | +1,071.79% |

| FY 2024–25 | 9,877 | +30.13% | 1,960 | +42.96% |

Zomato Dividend History

Zomato has not paid any dividends in the past.

| Year / Quarter | Dividend Per Share (₹) |

| FY2025 (May 2025) | No dividend |

| FY2024 (May 2024) | No dividend |

| FY2023 (Jun 2023) | No dividend |

| FY2022 (Aug 2022) | No dividend |

| FY2021 (May 2021) | No dividend |

| FY2020 (Feb 2020) | No dividend |

Shareholding Pattern

| Sep 2022 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | Jun 2025 | |

| FIIs | 54.88% | 55.11% | 54.11% | 52.53% | 47.31% | 44.36% | 42.34% |

| DIIs | 15.47% | 15.28% | 15.79% | 17.32% | 20.51% | 23.47% | 26.49% |

| Government | 0.00% | 0.00% | 0.00% | 0.00% | 0.03% | 0.10% | 0.10% |

| Public | 27.98% | 28.05% | 28.64% | 28.86% | 26.09% | 26.08% | 25.17% |

| Others | 1.66% | 1.58% | 1.45% | 1.27% | 6.07% | 5.98% | 5.91% |

How to Predict Zomato Share Price Target Tomorrow

If you’re trying to estimate Zomato’s share price for the next trading day, it’s helpful to combine past trends with reasonable growth assumptions. You can simply follow the below steps to predict Zomato Share price target tomorrow:

Step 1: Know the Current Trend

Zomato’s price has been rising. In August 2025, the price moved up by 3.44%, and the current price is around ₹317.00.

Step 2: Use a Daily Growth Estimate

Assume the stock grows about 5% per month, which means:

Daily growth ≈ 0.23%

Use this formula:

Tomorrow’s Price = Today’s Price × (1 + 0.0023)

Example:

If today’s price is ₹317.00

Tomorrow’s price ≈ ₹317.73

Step 3: Add Volatility Range

Zomato’s price can move up or down by around 2.5% daily.

So, tomorrow’s expected range is: ₹309.30 to ₹325.20

Frequently Asked Questions

1. Is Zomato a good stock to buy in 2025?

Ans:- Zomato shows strong revenue growth and expanding operations. The company can leverage AI and logistics automation to decrease operational costs and enhance delivery efficiency that will ultimately help to increase profitability margins, making it a promising long-term pick.

2. Is Zomato a Good Dividend Stock?

Ans:- No, Zomato is not a dividend stock. It has not provided any dividend since listing. The company is more focused on reinvestment for growth rather than paying out profits.

3. Does Zomato give dividends regularly?

Ans:- Zomato has never paid a dividend to date and has no history of regular dividend payouts.

4. What is the future outlook of Zomato stock?

Ans:- The outlook is positive with new revenue streams and market expansion. However, investors should consider profit consistency and competition.

5. What is the Zomato share price target 2025?

Ans:- Zomato share price target is expected to be in between Rs. 309 to Rs. 342 for the remaining months.

6. What is the Zomato share price target 2026?

Ans:- Zomato’s projected target for December 2026 is Rs. 392.09 with a possible range of Rs. 376 to Rs. 401.

7. What is the Zomato share price target 2027?

Ans:- Zomato share price target 2027 is expected to be up to Rs. 455.44. The stock is expected to trade in between Rs. 435 to Rs. 464.

8. What is the Zomato share target price 2028?

Ans:- Zomato is expected to reach Rs. 523.03 by December 2028. The stock can show momentum in the range of Rs. 422 to Rs. 529.

9. What is the Zomato share price target 2029?

Ans:- Zomato could trade around Rs. 594.91 by December 2029.

10. What is the Zomato share price target 2030?

Ans:- Zomato’s 2030 target is Rs. 667.14, with a bullish forecast as high as Rs. 1,006 in an optimistic scenario.

Read More:- Trident Share Price Target 2025

Read More:- Irfc Share Price Target 2025

Read More:- Tata Motors Share Price Target 2025

Read More:- Jio Finance Share Price Target 2025

Read More:– Alok Industries Share Price Target 2025

Read More:- RVNL Share Price Target 2025

Read More:- Bhel Share Price Target 2025

Read More:- NTPC Green Energy Share Price Target 2025

Disclaimer:

The share price targets for Zomato Ltd. presented here are intended for informational use only. These short-term and long-term projections are based on historical data and current market trends; however, actual future prices may differ due to market volatility and unforeseen factors. This forecast assumes favorable market conditions and does not consider unexpected risks, economic changes, or company-specific events. Investors are advised to perform their own due diligence before making any investment decisions.