Tata Motors’ share price has seen many ups and downs in 2025. However, the company has started gaining attention from investors again due to rising demand for electric vehicles. In this article, we’ve shared possible Tata Motors share price target 2025, 2026, 2027, till Tata motors share price target 2030 based on current trends and market outlook. We have also helped to understand how to compute tata motors share price target tomorrow.

About Tata Motors

Tata Motors Limited is one of the well-established companies of Tata Group and is known as one of the largest automobile manufacturers. It makes and sells a wide range of vehicles, such as passenger cars, trucks, buses, vans, and military vehicles. The company sells its products both in India and globally, with its premium automotive arm, Jaguar Land Rover (JLR), based in the UK. Tata Motors is also a key player in electric vehicles, with highest selling EV models Tata Nexon EV.

How Does Tata Motors Earn Revenue?

Tata Motors earns revenue through the sale of vehicles and related services, which includes:

- By selling passenger and commercial vehicles in India and internationally.

- By providing after-sales services such as maintenance, parts, accessories, and extended warranties.

- Currently, the company is focusing on selling electric cars in India to boost its revenue.

Tata Motors Share Price Target 2025

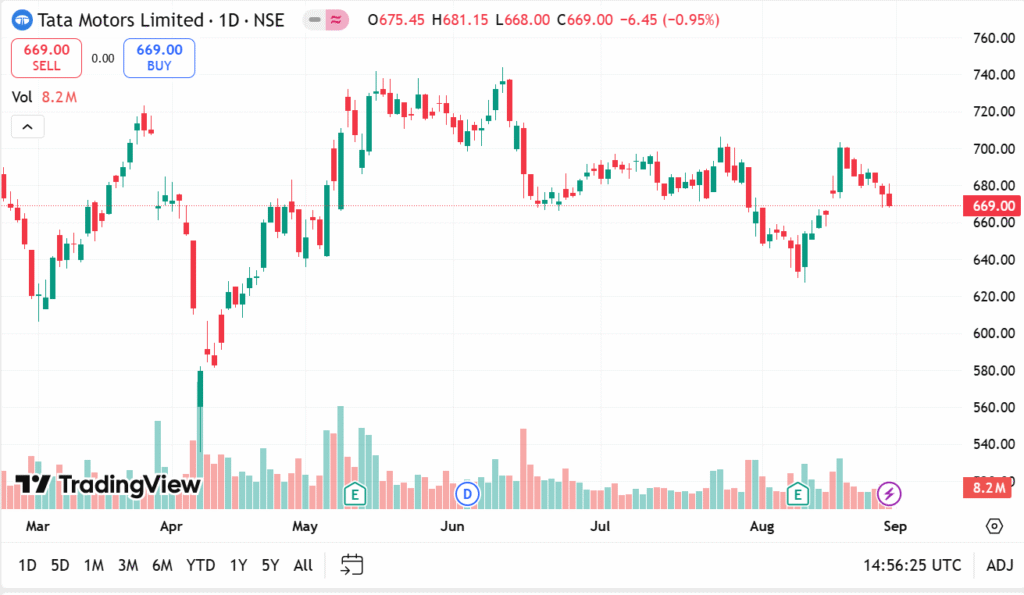

Current Price (August 2025) = Rs. 664

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| August | 664 | 710 | 532 – 868 |

| September | 710 | 760 | 565 – 887 |

| October | 760 | 820 | 630 – 933 |

| November | 820 | 880 | 678 – 957 |

| December | 880 | 1020 | 920 – 1028 |

Source: Dhan

Tata Motor Share Target Price 2026

Assumptions considered for Tata Motors Share Price Target 2025 to 2030

CAGR is assumed 18% based on the post-recovery scenario with Monthly growth rate of 1.39%, and Volatility band of ±12%.

No major macroeconomic shocks are considered as there are no situations currently like recession or regulatory risks.

Further, we have assumed steady EV & JLR performance to compute tata motor share target price.

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 1020 | 1034 | 910 – 1158 |

| February | 1034 | 1048 | 922 – 1173 |

| March | 1048 | 1063 | 935 – 1190 |

| April | 1063 | 1078 | 948 – 1207 |

| May | 1078 | 1093 | 961 – 1225 |

| June | 1093 | 1108 | 974 – 1244 |

| July | 1108 | 1124 | 987 – 1263 |

| August | 1124 | 1140 | 1003 – 1277 |

| September | 1140 | 1156 | 1016 – 1295 |

| October | 1156 | 1172 | 1027 – 1313 |

| November | 1172 | 1189 | 1045 – 1331 |

| December | 1189 | 1206 | 1060 – 1350 |

Tata Motor Share Target Price 2027

2027 Assumptions

- Annual CAGR assumed at 18% with Monthly Growth rate of around 1.39% compounded with volatility and Price Band: ±12%

- It is assumed that EV growth will be there and JLR can show consistent performance, especially in China and UK markets will bring growth.

- India’s economy expected to grow 6–7%

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 1206 | 1223 | 1076 – 1370 |

| February | 1223 | 1240 | 1091 – 1390 |

| March | 1240 | 1257 | 1106 – 1407 |

| April | 1257 | 1275 | 1122 – 1428 |

| May | 1275 | 1292 | 1137 – 1447 |

| June | 1292 | 1310 | 1153 – 1467 |

| July | 1310 | 1328 | 1169 – 1487 |

| August | 1328 | 1347 | 1184 – 1507 |

| September | 1347 | 1365 | 1202 – 1529 |

| October | 1365 | 1384 | 1218 – 1549 |

| November | 1384 | 1403 | 1235 – 1572 |

| December | 1403 | 1423 | 1251 – 1594 |

Tata Motors Share Target Price 2028

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 1423 | 1443 | 1270 – 1616 |

| February | 1443 | 1463 | 1288 – 1639 |

| March | 1463 | 1483 | 1305 – 1661 |

| April | 1483 | 1504 | 1324 – 1684 |

| May | 1504 | 1525 | 1342 – 1708 |

| June | 1525 | 1546 | 1359 – 1731 |

| July | 1546 | 1568 | 1379 – 1757 |

| August | 1568 | 1590 | 1399 – 1781 |

| September | 1590 | 1612 | 1418 – 1806 |

| October | 1612 | 1635 | 1439 – 1830 |

| November | 1635 | 1658 | 1459 – 1858 |

| December | 1658 | 1678 | 1476 – 1879 |

Tata Motors Share Target Price 2029

Assumptions

- Annual CAGR: 18%, Monthly Growth: ~1.39%, and Price Band: ±12%

- Tata likely becomes the largest EV player in India and JLR profits consistently contribute to consolidated EPS.

- Commercial vehicle demand is expected to rebound due to infra cycles.

- India aims for full EV adoption targets by 2030, which will drive demand.

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 1678 | 1701 | 1497 – 1905 |

| February | 1701 | 1725 | 1518 – 1932 |

| March | 1725 | 1749 | 1539 – 1958 |

| April | 1749 | 1773 | 1561 – 1985 |

| May | 1773 | 1797 | 1581 – 2013 |

| June | 1797 | 1822 | 1602 – 2040 |

| July | 1822 | 1847 | 1624 – 2068 |

| August | 1847 | 1872 | 1647 – 2096 |

| September | 1872 | 1898 | 1670 – 2125 |

| October | 1898 | 1924 | 1692 – 2153 |

| November | 1924 | 1950 | 1716 – 2184 |

| December | 1950 | 1979 | 1742 – 2214 |

Tata motors share price target 2030

Tata Motors’ share price shows steady growth, starting at Rs. 1,979 in January and ending at Rs. 2,335 in December, with an 18% increase over the year. Based on this data, Tata Motors share price target 2030 seems positive, with continued growth expected.

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 1979 | 2007 | 1766 – 2248 |

| February | 2007 | 2035 | 1791 – 2280 |

| March | 2035 | 2064 | 1816 – 2311 |

| April | 2064 | 2093 | 1842 – 2344 |

| May | 2093 | 2122 | 1868 – 2376 |

| June | 2122 | 2152 | 1894 – 2409 |

| July | 2152 | 2182 | 1920 – 2444 |

| August | 2182 | 2213 | 1947 – 2480 |

| September | 2213 | 2244 | 1975 – 2514 |

| October | 2244 | 2275 | 2002 – 2552 |

| November | 2275 | 2307 | 2030 – 2588 |

| December | 2307 | 2335 | 2055 – 2615 |

Tata Motors Share Price Target by Experts

JM Financial

Target Price: Rs. 815

Recommendation: Buy call

Rationale: JM Financial has given a “buy” rating to Tata Motors with a target price of Rs 815. Currently, the stock is trading around at Rs 733.75.

Tata motors share price target 2025 Motilal Oswal

Tata motors expect single digit growth in India’s CV and PV segments in FY26, targeting 40% CV market share by FY27 and 16% PV share by FY27. It plans seven new PV launches by FY30. Analysts have mixed ratings, with 18 “Buy”, 11 “Hold”, and 6 “Sell” recommendations.

Source: https://www.motilaloswal.com/news/stocks/95097

Tata Motors Share Future: Key Highlights

Tata Motors is the leading electric vehicle (EV) seller in India, selling high quality affordable EV models like the Nexon, Punch, Harrier, and Safari, along with Jaguar Land Rover that have helped the company reach a wide range of customers. The company has a strong presence in international markets that contribute towards strong revenue diversification and long-term stability. Additionally, government incentives for EVs and the development of charging infrastructure are boosting Tata Motors’ growth in both passenger and commercial vehicle segments.

Tata Motors Share Future: Challenges

The EV market in India is becoming highly competitive due to various other automobile brands like Mahindra, Hyundai, and several international brands entering the space. Tata Motors still heavily depends on the performance of Jaguar Land Rover (JLR), which can be affected by global economic conditions.

Few factors like rising input costs, including raw materials like lithium and steel, along with semiconductor shortages, may affect a company’s profit margin. Additionally, the company is making large capital investments in EV technology, battery plants, and R&D, which could put pressure on short-term earnings.

Future Growth Drivers for Tata Motors Ltd.

Tata Motors is a leader in India’s EV market, with popular models like the Nexon EV and Punch EV, and plans to expand with both affordable and premium models. Jaguar Land Rover (JLR) is improving margins with a recovery in luxury vehicle demand, a strong EV strategy, and cost optimization.

In India, growing infrastructure development and economic expansion are driving higher demand for commercial vehicles like trucks and buses. Tata Motors is also strengthening its global presence, especially in emerging markets, and investing in technology and innovation.

Tata Motors Share Price Fundamental Analysis

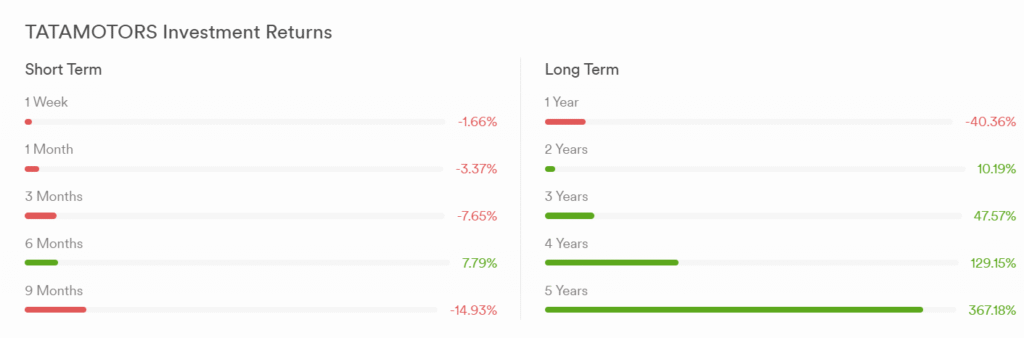

Tata Motors Past Returns

Tata Motors Financial Performance Overview (FY2020 – FY2025)

| Fiscal Year | Revenue | Revenue Growth | Net Profit | Profit Growth |

| FY2024-25 | 72,215 | -5.3% | 5,452 | -31% |

| FY2023-24 | 74,453 | 11.48% | 7,902 | 189.65% |

| FY2022-23 | 66,578 | 39.13% | 2,728 | 296.15% |

| FY2021-22 | 47,924 | 56.63% | -1,739 | 41.94% |

| FY2020-21 | 30,595 | -31.31% | -2,295 | 67.14% |

Tata Motors Dividend History

| Year / Quarter | Dividend Per Share (₹) |

| FY2025 | 6.00 |

| FY2024 | 6.00 |

| FY2023 | 2.00 |

| FY2022 | 0.00 |

| FY2021 | 0.00 |

| FY2020 | 0.00 |

Shareholding Pattern

| Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | Jun 2025 | |

| Promoters | 46.36% | 46.36% | 42.58% | 42.58% | 42.58% | 42.57% |

| FIIs | 19.20% | 18.18% | 20.54% | 18.66% | 17.84% | 17.17% |

| DIIs | 16.01% | 15.93% | 16.08% | 16.54% | 16.88% | 16.93% |

| Public | 0.14% | 0.14% | 0.29% | 0.31% | 0.31% | 0.31% |

| Others | 18.31% | 19.39% | 20.49% | 21.91% | 22.39% | 23.01% |

How to Predict Tata Motors Share Price Target Tomorrow

Step 1: Identify Historical Pattern to predict tata motors share price target tomorrow: The stock often moves within a ₹30–₹35 range and tends to perform better from August to October, driven by festive sales and exports.

Step 2: Monthly Growth: Tata Motors shows an average monthly growth of 5% and daily volatility of ±2.5%.

Formula:

Tata motors share price target tomorrow =Current Price * (1+Daily Change)

With a 5% monthly growth:

Daily Change=5%/22=0.23

For ₹664, tomorrow’s target is ₹665.53.

Step 3: Volatility Range:

- Lower Range: ₹647.60

- Upper Range: ₹680.40

So, tata motors share price target tomorrow could be between ₹647.60 and ₹680.40.

Frequently Asked Questions

1. Is Tata Motors a good buy for the long term?

Ans- Tata Motors shows strong growth potential, especially when we consider its demand in the electric vehicles sector like the Tata Nexon EV. Due to its diversified global presence, it is promising long-term returns. However, investors must consider risks such as market volatility and competition from other EV players.

2. Which Tata stock is best to buy for the long-term?

Ans- Tata Motors is a good stock to consider for long-term growth due to its sector growth. TCS is another good share for stable returns in the IT sector. If you are willing to take risks, then Tata Steel could be a good choice for higher returns.

3. What is Tata Motors share price target 2025?

Ans- The tata motors share price target 2025 is estimated in the range of Rs. 532 – Rs. 1028 depends upon various factors such as the growth of its EV segment, global market conditions, economic factors, and performance of Jaguar Land Rover.

4. Can Tata Motors stock reach Rs. 1200 by 2025?

Ans- As per estimate, tata motors share price target by 2025 is upto Rs. 1028. The price target of Rs. 1200 by 2025 is possible if the company successfully capitalizes on EV growth, strengthens its global position, and maintains profitability.

5. What is Tata Motors share price target 2026?

Ans- Tata motors share target price 2026 is expected to be in the range of Rs. 910 – Rs. 1350. It is expected that EV portfolio expansion and strengthening its presence in both domestic and international markets will be key parameters to achieve share price targets.

6. What will be the tata motors share price target 2030?

Ans- The Tata Motors share price target 2030 shows a gradual increase throughout the year. Starting at Rs. 1979 in January, the share price could end up around Rs. 2335 by December. Each month has a range, with the highest possible price reaching Rs. 2615 in December.

Read More:- Trident Share Price Target 2025

Read More:- Irfc Share Price Target 2025

Read More:- Zomato Share Price Target 2025

Read More:- Jio Finance Share Price Target 2025

Read More:– Alok Industries Share Price Target 2025

Read More:- Ireda Share Price Target 2025

Read More:- Idfc First Bank Share Price Target 2025

Read More:- RVNL Share Price Target 2025

Read More:- Bhel Share Price Target 2025

Read More:- NTPC Green Energy Share Price Target 2025

Disclaimer:

The share price targets for Tata Motors presented here are intended for informational use only. These short-term and long-term projections are based on historical data and current market trends; however, actual future prices may differ due to market volatility and unforeseen factors. This forecast assumes favorable market conditions and does not consider unexpected risks, economic changes, or company-specific events. Investors are advised to perform their own due diligence before making any investment decisions.