The YES Bank Share Price Target 2025 can give traders and investors predict where the stock might go by 2025. As YES Bank continues to recover and grow, these targets help investors decide if it’s a good time to buy or hold its shares. The projections are based on the bank’s performance, market trends, and future plans that can help traders to predict YES Bank Share Price Target 2025 and YES bank share price target tomorrow.

About YES Bank

YES Bank is a private-sector bank in India that provides a range of financial services. These services include:

- Retail banking services, which includes savings accounts, personal loans, credit cards, and mortgages for individual customers.

- Yes bank provides loans and services for businesses of all sizes.

- The bank also offers Investment advice and financial planning for individuals and businesses.

How Does YES Bank Earn Revenue?

YES Bank earns money in several ways:

- Interest on Loans: The bank lends money to individuals and businesses and charges interest on those loans.

- Fees and Charges: YES Bank collects fees for services like account maintenance, ATM withdrawals, and transaction processing.

- Investments: The bank earns revenue from investments in bonds, stocks, and other financial instruments.

- Wealth Management Services: YES Bank charges for investment advice and portfolio management.

- Cross-Selling Financial Products: The bank sells insurance, mutual funds, and other financial products, earning commissions.

YES Bank Share Price Target 2025

Current Price (September 2025) = Rs.19.14

| Month | Minimum Price (Rs) | Maximum Price (Rs) |

| September | 18.11 | 24.00 |

| October | 19.21 | 29.57 |

| November | 22.11 | 30.68 |

| December | 25.84 | 31.38 |

Source Dhan

Assumptions considered for YES Bank Share Price Target 2025 till YES Bank Share Price Target 2030

We have assumed increase at an annual growth rate of 7-10% for each year as YES Bank is now stabilizing and growing after previous challenges.

The monthly fluctuation is assumed to be around 1.5-2.5% month-to-month. This assumption is due to stock price volatility in the banking sector, especially for mid-cap banks.

January typically sees a slight increase due to the optimism of the new year, and December generally sees growth due to year-end rally effects.

YES Bank Share Target Price 2026

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 25.84 | 29.00 | 25.84 – 29.00 |

| February | 26.84 | 29.88 | 26.84 – 29.88 |

| March | 27.68 | 30.51 | 27.68 – 30.51 |

| April | 28.67 | 31.77 | 28.67 – 31.77 |

| May | 29.17 | 32.61 | 29.17 – 32.61 |

| June | 30.70 | 33.74 | 30.70 – 33.74 |

| July | 31.00 | 34.85 | 31.00 – 34.85 |

| August | 32.47 | 35.52 | 32.47 – 35.52 |

| September | 34.68 | 36.84 | 34.68 – 36.84 |

| October | 35.63 | 38.41 | 35.63 – 38.41 |

| November | 36.53 | 39.74 | 36.53 – 39.74 |

| December | 37.68 | 40.47 | 37.68 – 40.47 |

YES Bank Share Target Price 2027

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 40.87 | 44.91 | 40.87 – 44.91 |

| February | 41.97 | 46.01 | 41.97 – 46.01 |

| March | 43.10 | 47.16 | 43.10 – 47.16 |

| April | 44.24 | 48.32 | 44.24 – 48.32 |

| May | 45.39 | 49.48 | 45.39 – 49.48 |

| June | 46.56 | 50.67 | 46.56 – 50.67 |

| July | 47.74 | 51.87 | 47.74 – 51.87 |

| August | 48.94 | 53.08 | 48.94 – 53.08 |

| September | 50.15 | 54.30 | 50.15 – 54.30 |

| October | 51.38 | 55.53 | 51.38 – 55.53 |

| November | 52.62 | 56.77 | 52.62 – 56.77 |

| December | 53.87 | 58.02 | 53.87 – 58.02 |

YES Bank Share Target Price 2028

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 58.18 | 62.46 | 58.18 – 62.46 |

| February | 59.43 | 63.73 | 59.43 – 63.73 |

| March | 60.69 | 65.01 | 60.69 – 65.01 |

| April | 61.97 | 66.30 | 61.97 – 66.30 |

| May | 63.26 | 67.60 | 63.26 – 67.60 |

| June | 64.57 | 68.91 | 64.57 – 68.91 |

| July | 65.89 | 70.23 | 65.89 – 70.23 |

| August | 67.22 | 71.56 | 67.22 – 71.56 |

| September | 68.57 | 72.90 | 68.57 – 72.90 |

| October | 69.93 | 74.25 | 69.93 – 74.25 |

| November | 71.30 | 75.61 | 71.30 – 75.61 |

| December | 72.68 | 76.98 | 72.68 – 76.98 |

YES Bank Target Share Price 2029

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 77.39 | 82.12 | 77.39 – 82.12 |

| February | 78.83 | 83.58 | 78.83 – 83.58 |

| March | 80.29 | 85.05 | 80.29 – 85.05 |

| April | 81.76 | 86.53 | 81.76 – 86.53 |

| May | 83.24 | 88.01 | 83.24 – 88.01 |

| June | 84.73 | 89.51 | 84.73 – 89.51 |

| July | 86.23 | 91.01 | 86.23 – 91.01 |

| August | 87.74 | 92.52 | 87.74 – 92.52 |

| September | 89.26 | 94.04 | 89.26 – 94.04 |

| October | 90.79 | 95.57 | 90.79 – 95.57 |

| November | 92.32 | 97.11 | 92.32 – 97.11 |

| December | 93.86 | 98.66 | 93.86 – 98.66 |

YES Bank Share Price Target 2030

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| January | 99.42 | 104.49 | 99.42 – 104.49 |

| February | 100.99 | 105.98 | 100.99 – 105.98 |

| March | 102.56 | 107.48 | 102.56 – 107.48 |

| April | 104.14 | 109.00 | 104.14 – 109.00 |

| May | 105.73 | 110.52 | 105.73 – 110.52 |

| June | 107.33 | 112.05 | 107.33 – 112.05 |

| July | 108.94 | 113.59 | 108.94 – 113.59 |

| August | 110.56 | 115.14 | 110.56 – 115.14 |

| September | 112.19 | 116.70 | 112.19 – 116.70 |

| October | 113.82 | 118.26 | 113.82 – 118.26 |

| November | 115.47 | 119.84 | 115.47 – 119.84 |

| December | 117.12 | 121.43 | 117.12 – 121.43 |

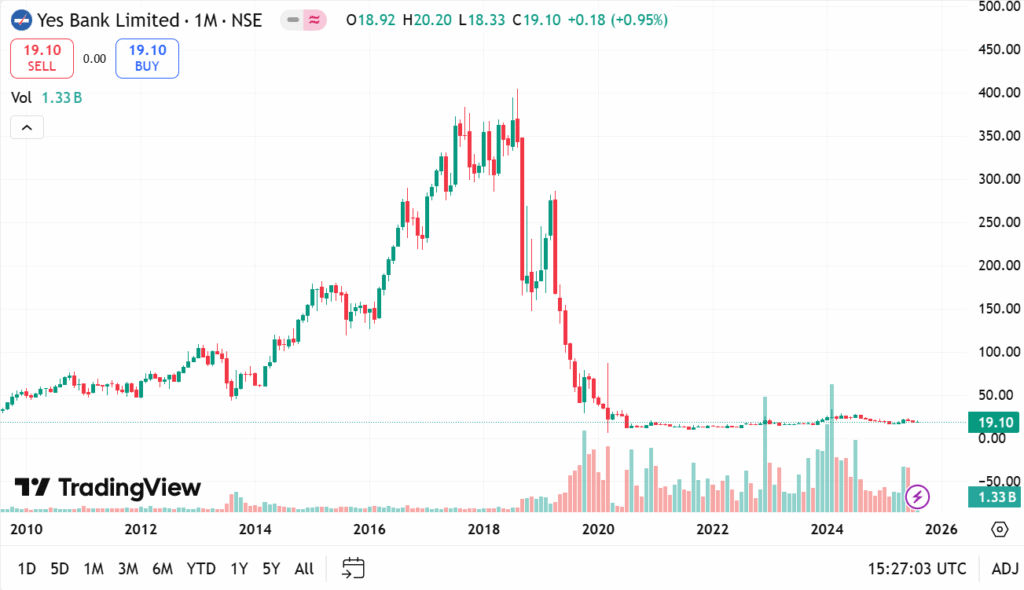

YES Bank share history

Rapid Growth Phase (2004-2015):

YES Bank witnessed a rapid growth and expansion during 2004 till 2015, which became one of India’s prominent private-sector banks. Its stock price rose significantly during this period due to its strong financial performance and increasing market share.

NPA Crisis and Decline (2018-2020):

Around 2018, the bank’s balance sheet began showing signs of stress as the number of NPAs started increasing and in 2019, Rana Kapoor (the founder and CEO) was forced to step down due to regulatory issues. By 2020, the bank was struggling with liquidity issues and had to raise capital through a bailout plan with State Bank of India (SBI) and other investors. Due to all negative factors such as, bad loans, governance issues, and regulatory intervention the YES Bank share price led to a sharp decline from a high of ₹400+ per share in 2017 to below ₹20 by mid-2020.

YES Bank Share Future: Key Highlights

The future of YES Bank looks promising as it continues its recovery, focusing on strengthening its balance sheet and expanding its digital services. The bank is likely to benefit from improving asset quality, strong retail banking growth, and increasing market share. Investors expect steady growth as YES Bank capitalizes on India’s growing banking sector.

YES Bank Share Future: Challenges

Despite positive growth, YES Bank faces challenges like competition from other private banks, managing non-performing assets (NPAs), and maintaining consistent profitability. Regulatory changes and economic conditions can also impact its future performance.

Future Growth Drivers for YES Bank

Key growth drivers for YES Bank include its push for digital banking services, strong corporate banking relationships, and expansion into new markets. Increased adoption of mobile banking, better risk management, and strategic partnerships will also fuel future growth.

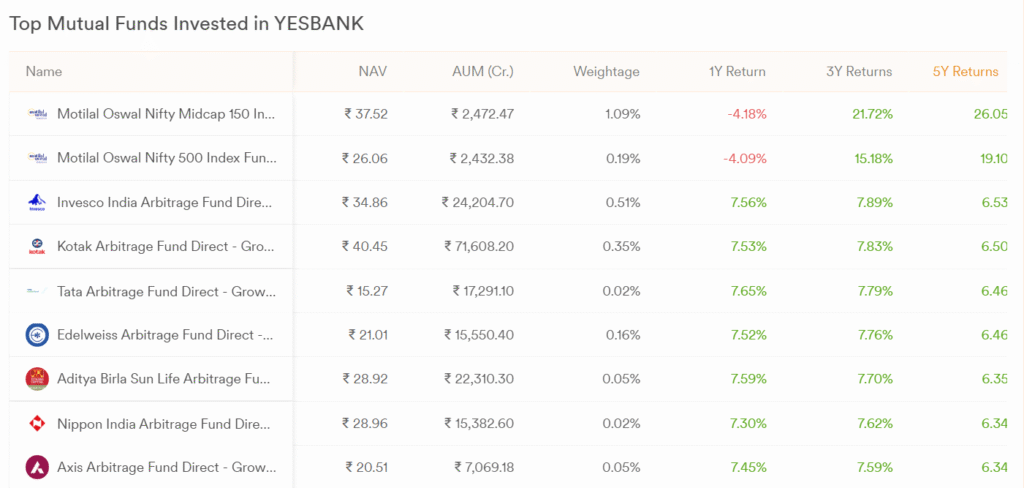

YES Bank Share Price Target 2024 By Motilal Oswal

As of now, Motilal Oswal has not shared any specific YES Bank Share Price Target 2024.

YES Bank Share Price Target Moneycontrol (https://www.moneycontrol.com/india/stockpricequote/banks-private-sector/yesbank/YB)

YES Bank Share Price Fundamental Analysis

YES Bank Financial Performance Overview (FY2020 – FY2025)

| Fiscal Year | Revenue | Revenue Growth | Net Profit | Profit Growth |

| FY2024-25 | 36,752 | 12.00% | 2,406 | 92.3% |

| FY2023-24 | 32,700 | 21.54% | 1,251 | 74.39% |

| FY2022-23 | 26,383 | 19.31% | 717 | -32.71% |

| FY2021-22 | 22,286 | -5.08% | 1,066 | 130.8% |

| FY2020-21 | 23,0541 | -23.11% | -3,462 | 78.91% |

YES Bank Dividend History

YES Bank declared its last dividend in FY2019, which was ₹2 per share. Since then, the company has not announced any further dividends.

| Year / Quarter | Dividend Per Share (₹) |

| FY2025 | 0.00 |

| FY2024 | 0.00 |

| FY2023 | 0.00 |

| FY2022 | 0.00 |

| FY2021 | 0.00 |

| FY2020 | 0.00 |

Shareholding Pattern

| Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | Jun 2025 | |

| Promoters | 22.01% | 27.08% | 27.00% | 26.74% | 26.88% | 24.95% |

| FIIs | 41.50% | 38.10% | 38.20% | 38.84% | 39.52% | 40.26% |

| DIIs | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| Public | 36.47% | 34.82% | 34.78% | 34.42% | 33.60% | 34.79% |

How to Predict YES Bank Share Price Target Tomorrow

Use Historical Price Behavior and Volatility Patterns

YES Bank’s stock has shown recurring price behavior as the ₹15–₹18 range acts as a frequent support/resistance zone.

It has been seen that the YES Bank share price momentum strengthens around the end of the financial year. The possible reason could be due to investor confidence in quarterly results or banking sector performance. Accordingly, a monthly growth rate of ~4% with ±3% volatility has been observed in past trends.

Now, the formula we are applying to estimate tomorrow’s target is as follows:

Tomorrow’s Estimate = Current Price * (1 + Expected Daily Change)

Assuming 4% monthly growth and 22 trading days, hence, expected Daily Change = 4% / 22 = 0.18%

So, if today’s price is ₹17.66:

Target Price Tomorrow = ₹17.66 * 1.0018 = ₹17.69.

Now, simply add or subtract ~3% for volatility-based range as Expected Range: ₹17.15 – ₹18.23

Please note that this method assumes the stock’s behavior follows a past pattern, however, Yes bank share price target tomorrow prediction are still subject to market news and sudden changes.

Frequently Asked Questions

What is the YES Bank Share Price Target 2025?

YES Bank share price target 2025 could range between ₹18-₹31 if YES Bank continues its recovery and strengthens its balance sheet. However, it is advisable to track quarterly results of YES Bank to predict YES Bak share price targets.

Is it good to invest in Yes Bank?

YES Bank could be a good investment for those who are ready for moderate to high risk. The bank has recently started showing recovery but its past issues (e.g., asset quality concerns) are still under monitoring. If you’re looking for steady growth and are willing to tolerate some volatility, it may be worth considering.

Can Yes Bank be a multibagger?

It is difficult to predict multibagger shares. For that, one must keep tracking their quarterly performance and corporate governance. YES Bank has the potential to become a multibagger if it continues its recovery and if the banking sector does well in the future. Don’t bet on YES BANK unless you’re ready for high volatility and long-term holding.

What is the yes Bank share price target 2030?

YES Bank share price target 2030 is predicted to range between ₹99.11 and ₹121.30. This growth is expected only if YES Bank performs well and the banking sector experiences growth; otherwise, the targets will be adjusted based on the bank’s performance.

What is the yes bank share price target tomorrow?

The current price of YES Bank shares is ₹17.66. Based on recent trends, the expected daily change is approximately 0.23%, which suggests an upward target of ₹17.69 for tomorrow. Considering market volatility, the price could fluctuate within a range of ₹17.15 to ₹18.23.

Disclaimer:

The share price targets for YES Bank share price target 2025 presented here are intended for informational use only. These short-term and long-term projections are based on historical data and current market trends; however, actual future prices may differ due to market volatility and unforeseen factors. This forecast assumes favorable market conditions and does not consider unexpected risks, economic changes, or company-specific events. Investors are advised to perform their own due diligence before making any investment decisions.

Read More:- RVNL Share Price Target 2025

Read More:- Bhel Share Price Target 2025

Read More:- NTPC Green Energy Share Price Target 2025

Read More:- Trident Share Price Target 2025

Read More:- Irfc Share Price Target 2025

Read More:- Zomato Share Price Target 2025

Read More:- Jio Finance Share Price Target 2025

Read More:– Alok Industries Share Price Target 2025

Read More:- Ireda Share Price Target 2025

Read More:- Idfc First Bank Share Price Target 2025

Read More:- RVNL Share Price Target 2025