Investors are regularly tracking share price movements of IRFC (Indian Railway Finance Corporation). The stock is getting strong attention due to its solid government backing and consistent business model. The stock has delivered strong gains in recent years. IRFC has become a popular stock among market watchers and long-term investors despite market corrections.

In this blog, we’ll look at the IRFC share price target 2025, 2026, 2030, 2040, and even 2050. These targets are based on various factors such as the company’s order book, history and current market trends, company fundamentals, expert analysis, and few basic assumptions.

Why are Investors Chasing Indian Railway Finance Corporation Share Price Target 2025?

Investors like IRFC share price target 2025 because it has a simple and low-risk business model with steady income and strong government support. As India is heavily investing in the railway sector, it is expected that IRFC will benefit in the coming years. Looking ahead, the IRFC share price target 2030 also shows strong growth potential, which makes it a good option for long-term investors who want steady returns and future gains.

About IRFC

If you want to know whether investing in IRFC is a good move then, you must be aware about Indian Railway Finance Corporation share price target 2025. In this article, we have broken down everything you should know: how IRFC makes money and why are people so interested in its future?

IRFC is a government-owned company that started operations in 1986. The company provides Indian railways with the funds it needs to operate and expand. IRFC plays a role in raising funds to keep the railway sector running and support the development of new railway projects.

IRFC share price target prediction 2025 reflects the company’s strong and stable business model. IRFC works behind the scenes to make sure Indian Railways has the trains, coaches, and wagons it needs. It leases these to the Railways for long periods – usually 30 years. It also gives loans to other railway-related companies like RVNL, Railtel, and Konkan Railway.

How Does IRFC Earn Revenue?

IRFC earns money by leasing trains, coaches, and wagons to Indian Railways and railways pay rent over a period of usually 30 years.

IRFC gives loans to railway related companies (like RVNL, Railtel, etc.) and earns interest from them.

IRFC gets strong support from the government, so it can borrow money at low interest rates and lend it at higher rates.

IRFC sources of income are safe and steady as most of its income is fixed and guaranteed, as it deals mostly with government-backed projects.

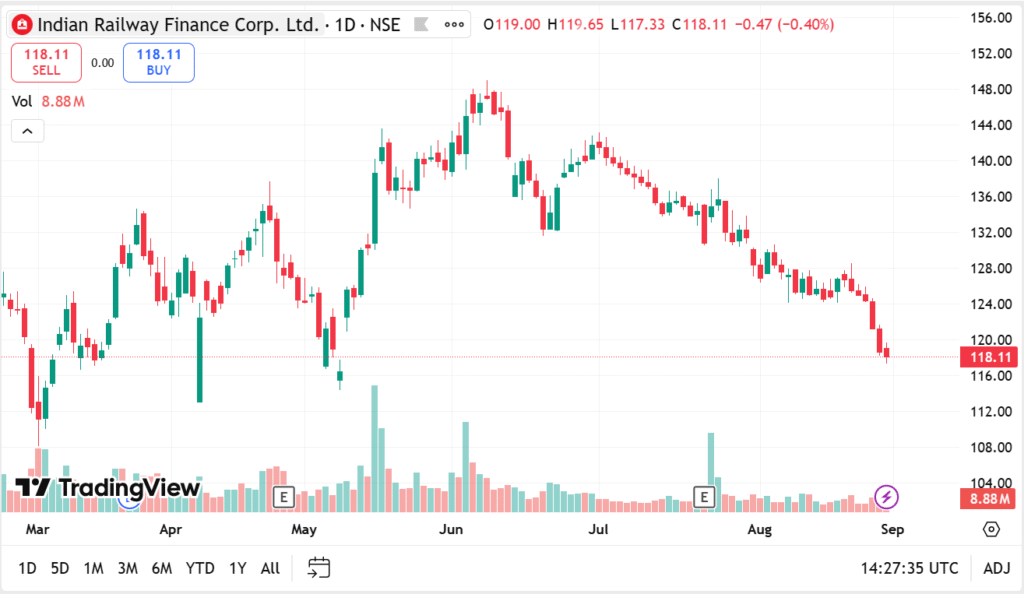

IRFC Share History

| Month | Average Price (₹) | Lowest Price (₹) | Highest Price (₹) | Annual % Change |

| Aug 2025 | 125.28 | 124.10 | 130.55 | -29.85% |

| Jul 2025 | 128.34 | 127.00 | 143.15 | -33.75% |

| Jun 2025 | 141.72 | 131.56 | 148.95 | -18.45% |

| May 2025 | 138.95 | 114.33 | 143.61 | -21.84% |

| Apr 2025 | 12s4.47 | 113.00 | 137.66 | -20.85% |

| Mar 2025 | 124.42 | 108.04 | 134.60 | -12.61% |

| Feb 2025 | 112.42 | 111.70 | 155.52 | -23.40% |

| Jan 2025 | 150.94 | 127.71 | 156.80 | -13.82% |

| Dec 2024 | 149.04 | 144.70 | 166.90 | +50.00% |

| Nov 2024 | 149.34 | 137.80 | 161.00 | +100.02% |

| Oct 2024 | 155.96 | 132.80 | 159.90 | +114.79% |

| Sep 2024 | 158.72 | 151.70 | 180.25 | +107.35% |

| Aug 2024 | 178.62 | 175.13 | 195.65 | +138.85% |

| Jul 2024 | 193.65 | 164.15 | 229.00 | +152.91% |

| Jun 2024 | 173.81 | 151.20 | 200.00 | -2.24% |

| May 2024 | 177.80 | 142.45 | 192.80 | +28.09% |

| Apr 2024 | 157.25 | 135.30 | 164.20 | +10.47% |

| Mar 2024 | 142.35 | 116.65 | 151.40 | +26.56% |

| Feb 2024 | 146.75 | 127.65 | 183.25 | +30.42% |

| Jan 2024 | 175.15 | 97.80 | 192.80 | +76.30% |

| Dec 2023 | 99.35 | 74.60 | 104.10 | +33.09% |

| Nov 2023 | 74.65 | 71.05 | 78.50 | +2.82% |

| Oct 2023 | 72.60 | 65.75 | 80.80 | -5.16% |

| Sep 2023 | 76.55 | 50.10 | 92.35 | +52.49% |

Assumptions considered for IRFC Share Price Target 2025 – 2030

- Assume start price or Indian Railway Finance Corporation share price target = ₹125.28 in Aug 2025

- Assumed a 10% annual stock price growth, compounded monthly. Hence, Monthly Growth Rate = (1+Annual Rate)1/12 −1 =(1+0.10)1/12−1≈0.007974≈0.8%, so each month: End Price=Start Price * 1.008.

- Consider monthly volatility like below before calculating IRFC share price target prediction 2025:

Min Price = Start Price × 0.95

Max Price = Start Price × 1.05

This gives a ±5% trading range, which is common in mid-cap or high-beta stocks.

- We have assumed Feb, Mar, Apr get higher monthly growth = +2.5% (instead of +0.8%) due to budget sessions that give boost to PSUs stock and Rest of the months remain at +0.8%

- Since the real market can be volatile, these are projection estimates, not guaranteed values.

IRFC Share Target Price 2025

The IRFC share price target 2025 shows a steady upward trend in the remaining year 2025. Starting at ₹125.28 in September 2025, the stock is projected to gradually rise, reaching ₹129.34 by December 2025, supported by increased infrastructure investments.

IRFC share price target prediction 2025 chart below:

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Sep-25 | 125.28 | 126.28 | 119.02–131.54 |

| Oct-25 | 126.28 | 127.29 | 119.97–132.59 |

| Nov-25 | 127.29 | 128.31 | 120.93–133.65 |

| Dec-25 | 128.31 | 129.34 | 121.89–134.73 |

Source: Dhan

IRFC Share Price Target 2026

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan-26 | 129.34 | 130.38 | 122.87–135.81 |

| Feb-26 | 130.38 | 133.64 | 123.86–136.90 |

| Mar-26 | 133.64 | 137 | 126.96–140.32 |

| Apr-26 | 137 | 140.43 | 130.15–143.85 |

| May-26 | 140.43 | 141.56 | 133.41–147.45 |

| Jun-26 | 141.56 | 142.69 | 134.48–149.63 |

| Jul-26 | 142.69 | 143.83 | 135.56–150.82 |

| Aug-26 | 143.83 | 144.98 | 136.64–152.03 |

| Sep-26 | 144.98 | 146.14 | 137.73–153.23 |

| Oct-26 | 146.14 | 147.31 | 138.83–154.45 |

| Nov-26 | 147.31 | 148.49 | 139.94–155.68 |

| Dec-26 | 148.49 | 149.68 | 141.07–156.91 |

IRFC Share Price Target 2027

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan-27 | 149.68 | 150.88 | 142.20–158.16 |

| Feb-27 | 150.88 | 154.65 | 143.34–158.42 |

| Mar-27 | 154.65 | 158.52 | 146.92–162.38 |

| Apr-27 | 158.52 | 162.48 | 150.60–166.45 |

| May-27 | 162.48 | 163.78 | 154.35–170.60 |

| Jun-27 | 163.78 | 165.09 | 155.59–172.96 |

| Jul-27 | 165.09 | 166.41 | 156.84–174.34 |

| Aug-27 | 166.41 | 167.74 | 158.09–175.73 |

| Sep-27 | 167.74 | 169.08 | 159.35–177.13 |

| Oct-27 | 169.08 | 170.43 | 160.63–178.54 |

| Nov-27 | 170.43 | 171.79 | 161.91–179.95 |

| Dec-27 | 171.79 | 173.16 | 163.20–181.38 |

IRFC Share Price Target 2028

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan-28 | 173.16 | 174.54 | 164.50–182.82 |

| Feb-28 | 174.54 | 178.9 | 165.81–183.27 |

| Mar-28 | 178.9 | 183.37 | 169.96–188.85 |

| Apr-28 | 183.37 | 187.95 | 174.20–194.54 |

| May-28 | 187.95 | 189.45 | 178.55–197.35 |

| Jun-28 | 189.45 | 190.96 | 179.98–199.92 |

| Jul-28 | 190.96 | 192.48 | 181.41–201.46 |

| Aug-28 | 192.48 | 194.01 | 182.86–203.11 |

| Sep-28 | 194.01 | 195.56 | 184.31–204.71 |

| Oct-28 | 195.56 | 197.11 | 185.78–206.34 |

| Nov-28 | 197.11 | 198.68 | 187.25–207.96 |

| Dec-28 | 198.68 | 200.26 | 188.75–209.61 |

IRFC Share Price Target 2029

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan-29 | 200.26 | 201.85 | 190.25–211.28 |

| Feb-29 | 201.85 | 206.9 | 191.76–212.96 |

| Mar-29 | 206.9 | 212.07 | 196.56–218.25 |

| Apr-29 | 212.07 | 217.37 | 201.47–223.92 |

| May-29 | 217.37 | 219.11 | 206.50–229.23 |

| Jun-29 | 219.11 | 220.86 | 208.15–231.07 |

| Jul-29 | 220.86 | 222.63 | 209.82–232.90 |

| Aug-29 | 222.63 | 224.41 | 211.50–234.76 |

| Sep-29 | 224.41 | 226.21 | 213.19–236.63 |

| Oct-29 | 226.21 | 228.02 | 214.90–238.52 |

| Nov-29 | 228.02 | 229.84 | 216.62–240.42 |

| Dec-29 | 229.84 | 231.68 | 218.35–242.33 |

IRFC Share Price Target 2030

The IRFC Share Price Target 2030 shows a steady rise from ₹231.68 in January to ₹268 by December. Throughout the year, the stock is expected to trade within a range of ₹220.10 to ₹278.10, indicating consistent growth.

| Month | Start Price (₹) | End Price (₹) | Price Range (₹ Min–Max) |

| Jan-30 | 231.68 | 233.52 | 220.10–244.25 |

| Feb-30 | 233.52 | 239.36 | 221.84–246.19 |

| Mar-30 | 239.36 | 245.34 | 227.39–252.33 |

| Apr-30 | 245.34 | 251.47 | 233.07–258.61 |

| May-30 | 251.47 | 253.48 | 238.89–264.04 |

| Jun-30 | 253.48 | 255.51 | 240.80–265.15 |

| Jul-30 | 255.51 | 257.56 | 242.73–267.29 |

| Aug-30 | 257.56 | 259.61 | 244.68–269.44 |

| Sep-30 | 259.61 | 261.69 | 246.63–271.60 |

| Oct-30 | 261.69 | 263.78 | 248.61–273.76 |

| Nov-30 | 263.78 | 265.88 | 250.59–275.93 |

| Dec-30 | 265.88 | 268 | 252.59–278.10 |

Indian Railway Finance Corporation Share Price Target 2025 by Experts

No latest recommendations are shared related to IRFC share price target Motilal Oswal or any other experts.

Future of IRFC Share: Key Highlights for IRFC Target Price 2025

Strong Government Support – IRFC gets strong support as it’s a government-owned company under Indian Railways.

Railway Expansion – As Indian Railways expands, IRFC will help by providing the needed funds.

Stable Business Model – IRFC earns stable income through leasing and lending with low risk.

Dividend stock – IRFC has a track record of paying consistent dividends to its shareholders.

Low NPAs – It has almost zero bad loans since it mostly deals with government projects.

Growing Retail Interest – More small investors are showing interest due to its strong backing and rising stock price.

IRFC Share Future: Challenges

Limited Diversification: Revenue mainly depends on Indian Railways, with minimal income from other sources.

Government Control: The company’s decisions are in control of the government that can restrict various parameters with significant influence.

Interest Rate Risk: Higher borrowing costs can eat away profit margins.

Long-Term Project Returns: Investments yield returns over long periods, which may deter short-term or aggressive investors.

IRFC Share Future Growth Drivers:

Projects like Vande Bharat, bullet trains, and station redevelopment required huge funding that will lead to revenue growth.

India’s push for better infrastructure and logistics will increase the need for railway financing.

IRFC can grow by leasing new assets like green energy trains or digital systems.

IRFC can also finance eco-friendly railway projects, which could attract global investors.

IRFC Share Price Fundamental Analysis

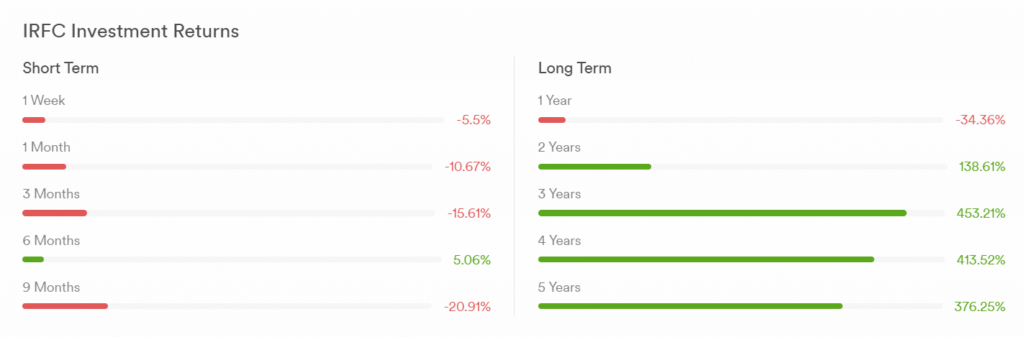

IRFC Past Returns

IRFC Financial Performance Overview (FY2020 – FY2025)

| Financial Year | Revenue (₹ Cr) | Revenue Growth | Net Profit (₹ Cr) | Profit Growth |

| FY2025 | 27,157 | +1.89% | 6,502 | +1.40% |

| FY2024 | 26,645 | +12.34% | 6,412 | +3.97% |

| FY2023 | 23,763 | +16.86% | 6,167 | +1.27% |

| FY2022 | 20,302 | +28.72% | 6,090 | +37.90% |

| FY2021 | 15,771 | +17.51% | 4,416 | +38.35% |

IRFC Dividend History

| Year | Dividend Per Share (₹) |

| FY2025 | 0.80 (Interim – Mar 2025) |

| FY2024 | 1.50 (Interim 0.80 – Nov 2024 + Final 0.70 – Aug 2024) |

| FY2023 | 1.50 (Interim 0.80 – Nov 2023 + Final 0.70 – Sep 2023) |

| FY2022 | 1.43 (Interim 0.80 – Nov 2022 + Final 0.63 – Sep 2022) |

| FY2021 | 1.82 (Interim 1.05 – Feb 2021 + Interim 0.77 – Nov 2021) |

Shareholding Pattern

| Shareholder | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | Jun 2025 |

| Promoters | 86.36% | 86.36% | 86.36% | 86.36% | 86.36% | 86.36% |

| FIIs | 1.08% | 1.11% | 1.09% | 1.01% | 0.98% | 0.93% |

| DIIs | 0.89% | 1.08% | 1.08% | 1.24% | 1.34% | 1.45% |

| Public | 11.68% | 11.45% | 11.48% | 11.40% | 11.32% | 11.24% |

How to Predict IRFC Share Price Target Tomorrow

Step 1. Start with the current price like IRFC Share Price in August 2025 is ₹125.28.

Step 2: Use monthly growth:

IRFC usually grows about 10% a year, which means about 0.8% growth every month. So next month’s price ≈ today’s price × 1.008.

Step 3: Higher growth in budget months:

In February, March, and April, the price grows faster assuming around 2.5% per month because of government budget boosts.

Step 3: Calculate daily growth to compute IRFC share price target today:

There are around 22 trading days in a month, so daily growth is monthly growth divided by 22.

For normal months: 0.8% ÷ 22 ≈ 0.036% daily growth.

For budget months: 2.5% ÷ 22 ≈ 0.114% daily growth.

Step 4: Predict IRFC share price target tomorrow:

Example for a normal month:

Tomorrow’s price = today’s price × (1 + daily growth)

= ₹125.28 × 1.00036 ≈ ₹125.32.

Step 5: Consider volatility:

The stock price can go up or down about 5% in a day.

So, price range = today’s price × 0.95 to today’s price × 1.05 = ₹119.02 to ₹131.54.

Similarly, you can compute IRFC share price target 2040 till IRFC share

Frequently Asked Questions

1. Is IRFC a Good Dividend Stock?

Ans:- IRFC is considered a strong dividend-paying stock with a dividend yield of around 1.26%. Investors consider this stock to generate consistent returns in the form of IRCF.

2. Does IRFC give dividends regularly?

Ans:- Yes, IRFC has a track record of paying dividends regularly. The company has recently announced an interim dividend of Rs. 0.80 per share in March 2025.

3. What is the IRFC share price target for the long term?

Ans:- IRFC has a positive long-term outlook. The company is highly supported by government investment and a strong business model. Its share price is predicted to rise from around ₹125 in 2025 to around ₹265–₹278 by 2030.

4. What is the IRFC share price target 2026?

Ans:- For 2026, IRFC’s share price is projected to start around ₹129 and close near ₹150. Monthly price range may be between ₹123 (minimum) and ₹157 (maximum).

5. What is the expected price range for IRFC shares in 2027?

Ans:- In 2027, IRFC shares are expected to rise with a price range between ₹142 and ₹181. The year-end target price is around ₹173.

6. What is the IRFC Share Price Target in 2028?

Ans:- IRFC’s stock price is forecasted about ₹173 at the start of 2028 to over ₹200 by year-end. Monthly price range could be ₹165 and ₹210 with consistent upward momentum.

7. What is the IRFC Share Price Target in 2029?

Ans:- IRFC shares may trade between ₹190 and ₹242, with a year-end target near ₹232in 2029.

8. What is the IRFC Share Price Target 2030?

Ans:- The price in 2030 is expected to rise further, with monthly ranges from ₹220 to ₹278. The year-end price target is approximately ₹268.

Read More:- Trident Share Price Target 2025

Read More:- Tata Motors Share Price Target 2025

Read More:- Zomato Share Price Target 2025

Read More:- Jio Finance Share Price Target 2025

Read More:– Alok Industries Share Price Target 2025

Read More:- RVNL Share Price Target 2025

Read More:- Bhel Share Price Target 2025

Read More:- NTPC Green Energy Share Price Target 2025

Disclaimer:– IRFC Share Target Price presented here are intended for informational use only. These short-term and long-term projections are based on historical data and current market trends; however, actual future prices may differ due to market volatility and unforeseen factors. This forecast assumes favorable market conditions and does not consider unexpected risks, economic changes, or company-specific events. Investors are advised to perform their own due diligence before making any investment decisions.